In programmatic display advertising, header bidding is a technology that helps to monetize a publisherʼs inventory by allowing bids for ad slots from multiple ad networks. Nearly 85% of the top 10k US websites implement header bidding, which illustrates its widespread adoption and effectiveness. Adopting header bidding technologies benefits both publishers and advertisers, leading to increased revenue opportunities.

Display ad campaigns are often utilized to increase brand awareness. This is why cost per mille (CPM) pricing models are the preferred choice, as such campaigns rely on high volume. At the same time, display ad campaigns suffer from low conversion rates. To increase conversion rates, advertisers are interested partners that provide contextual targeting and re-targeting — two of the major strengths of Criteo as an ad network that helped them to acquire a dominant position on the market. The goal of the article is to understand how dominant Criteo’s position is and what suitable alternatives are for publishers and advertisers.

Understanding Header Bidding Space

When publishers decide to implement header bidding, they struggle to select the right ad network. To better understand the header bidding space, this article uncovers the structure of the header bidding ecosystem by analyzing top networks in terms of the number of bids and achieved CPMs.

As with every study, we first need to collect some data. We focus on prebid.js wrapper, as it is one of the industry standards for header bidding. Prebid.js was launched in 2015 to make header bidding easy for publishers by bringing conformity and simplicity to the header bidding process. To collect data, we developed a browser extension that monitors all non-encrypted aspects of the bidding process, including winning and losing bid IDs, auction IDs, bidding prices, etc.

Over 90 days, we collected data from 75 news websites, representing publishers across various European markets, including Germany, Great Britain, France, Switzerland, Austria, and Bulgaria.

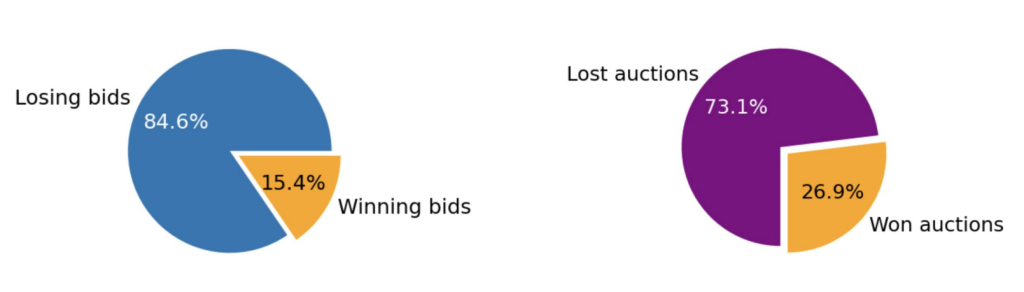

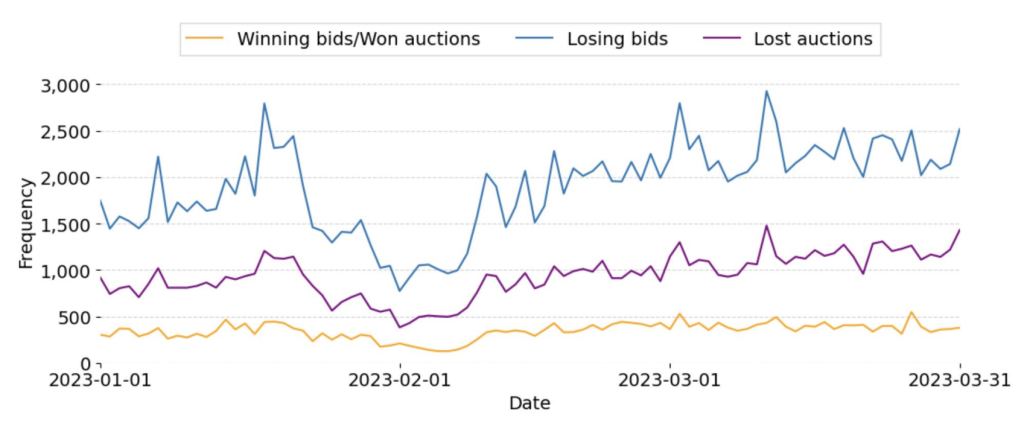

The data has been collected in the first quarter of 2023, building a dataset comprising 191.638 bids across 110.296 auctions. Among these bids, we observed 29.942 as successful (winning), constituting 15.4% of all bids and accounting for 26.9% of auctions won through header bidding. The remaining 73.1% represent lost auctions, wherein inventory was sold through means other than header bidding, such as direct buy contracts.

On average, we observed about 356 winning bids/won auctions per day.

Which are the top networks?

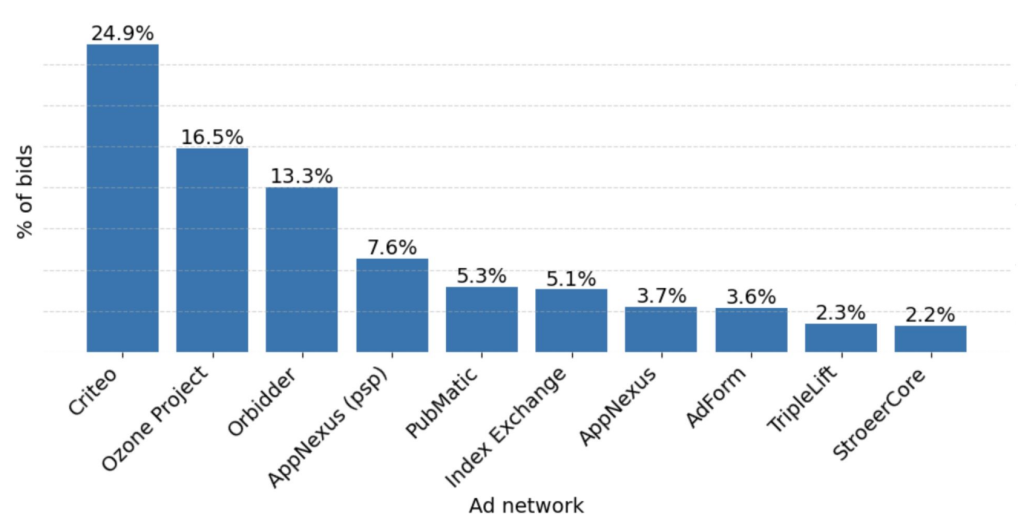

During the reported period, we identified a total of 81 distinct ad networks. Criteo emerged as the predominant ad network, accounting for nearly a quarter of all bids. Following closely are Ozone Project and Orbidder, each contributing one-seventh of the total bids. The top three networks make up over 50% of the whole traffic.

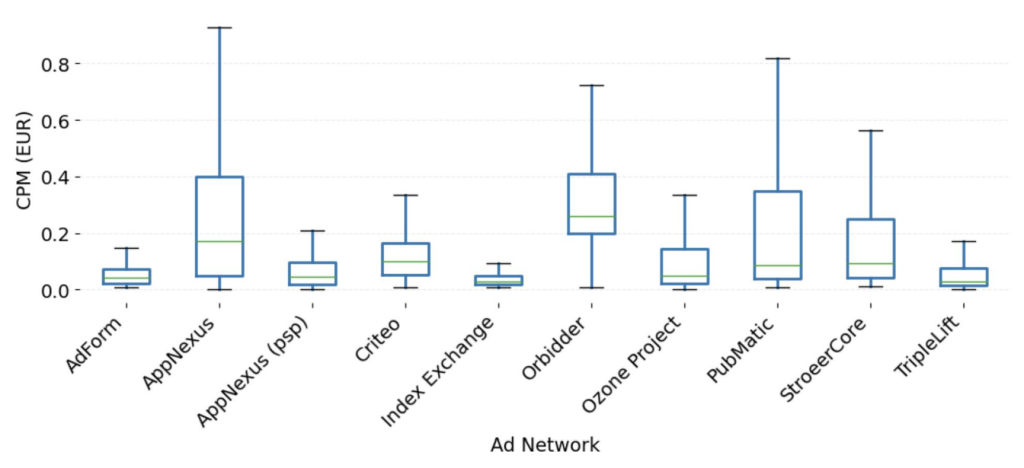

Orbidder reveals the highest median CPM, followed by AppNexus. Index Exchange depicts the lowest median and low variability in CPM, along with AdForm and TripleLift. AppNexus and PubMatic exhibit the highest CPM variability, followed by Orbidder and StroeerCore. Criteo achieves a median CPM of about 0.1€.

To Wrap It Up

Publishers can monetize their inventory in various ways by configuring, for example, the number of ad networks, ad slots, and latency times for bids. In this post, we saw that 26.9% of header bidding auctions are winning against direct buy contracts. While there is a high number of ad networks configured for header bidding by publishers, the majority of the bids flows through only few networks. In this context, Criteo emerges as the ad network with most of the traffic in terms of bids while still achieving a competitive median CPM.

The obtained results provide insights for enhancing and refining your programmatic media planning and buying, but if you would like to get deeper insights, sign up for our newsletter to get a free copy of AdBubble’s Header Bidding Report. The report looks at additional aspects of the bidding process, including the quality of the publisher, the geographic location of the visitor while visiting the website, the time period (i.e., time of the day and day of the week), and the offered banner sizes.

Sign up for our newsletter to get a free copy of our header bidding report!